As institutional capital continues to flow into Southern Europe, Luxembourg’s Special Limited Partnership (SCSp) has emerged as a powerful tool to structure real estate investment vehicles targeting Spain. With flexible governance, tax transparency, and investor-centric design, the SCSp is ideally suited for deploying capital into high-growth Spanish urban markets such as Madrid, Barcelona, Valencia, Malaga, and Seville.

Spain’s Real Estate Momentum: A Market in Transition

Spain is experiencing a strong rebound in real estate activity:

-

€17.5 billion: Total commercial real estate investment in Spain in 2023

-

+20% YoY growth in logistics and light industrial segments

-

Build-to-Rent (BTR) stock (residential) in Madrid and Barcelona expanded by 13.2% in 2023

-

Hotel sector RevPAR in Spain increased by +15.9% year-over-year

Spain’s major cities offer strategic entry points for value-add investment strategies:

| City | Investment Focus | Key Drivers |

|---|---|---|

| Madrid | BTR, Office, Hotels | Economic hub, HQ relocations, talent pool |

| Barcelona | BTR, Life Sciences, Co-working | Innovation hub, global tourism, startup culture |

| Valencia | Logistics, Light Industrial | Port activity, low-cost labor, regional access |

| Malaga | Tech Offices, BTR | “Spanish Silicon Valley,” expat migration |

| Seville | Hospitality, Student Housing | University city, culture-driven redevelopment |

Why Set Up a Luxembourg SCSp to Invest in Spain?

Tax Neutrality

-

The SCSp itself is not subject to corporate income tax, net wealth tax, or municipal business tax.

-

Income is taxed only at the investor level, subject to treaty planning and structuring.

Governance & Privacy

-

No requirement to publish financial statements.

-

Investors’ identities are not publicly disclosed.

-

Full flexibility in drafting capital commitments, distributions, and governance rules in the Limited Partnership Agreement (LPA).

Regulation Optional

-

Can operate as an unregulated alternative investment fund or elect the RAIF regime for AIFMD passporting, without CSSF approval.

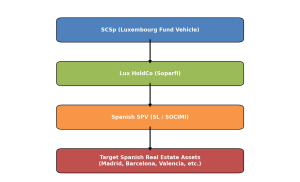

SCSp Structure Tailored for Spanish Real Estate

A streamlined cross-border investment setup often includes:

-

SCSp (Luxembourg) – Main fund vehicle

-

Soparfi (Lux Holding Company) – Intermediate entity for tax and treaty benefits

-

Spanish SL or SOCIMI – Local SPV for direct property acquisition and operations

This configuration enables centralized fund management in Luxembourg while optimizing tax treatment and operational access in Spain.

Fast Track to Market: 3 Days to Incorporate, 3 Weeks to Launch

One of the most attractive features of the SCSp is the speed of setup:

-

SCSp Formation: Can be completed in as little as 3 business days. No notarial deed is required—only a private agreement (the LPA) and registration with the Luxembourg Trade and Companies Register.

-

Full Fund Readiness: The complete fund setup—banking, administration, KYC/AML, and onboarding investors—can typically be achieved within 3 weeks.

This allows managers to act swiftly on real estate opportunities in competitive markets like Madrid or Valencia.

Popular SCSp Investment Strategies in Spain

Build-to-Rent (BTR) in Madrid and Barcelona

-

High demand from urban professionals

-

Gross rental yields of 4.0–4.5% outperform core EU cities

Hotel Conversions in Seville and Malaga

-

Boutique hotels, hostels, and repositioned properties

-

RevPAR in Andalusian cities rose by +18% in 2023

Last-Mile Logistics in Valencia and Zaragoza

-

Industrial vacancy below 4%

-

Excellent access to Spanish and Southern EU markets

Office Repositioning in Tier-2 Cities

-

Converting outdated offices into co-working or hybrid-use spaces

-

Strong demand from startups and remote-first firms

Investor Base and Fundraising Outlook

A Luxembourg SCSp offers a globally recognized, institutional-grade framework that attracts:

-

European and U.S. family offices

-

Private banks and UHNWIs

-

Middle Eastern sovereign wealth

-

EU institutional capital (via RAIF structure if desired)

The SCSp allows full customization of distribution waterfalls, hurdle rates, GP/LP rights, and exit mechanisms.

For real estate investors eyeing Spain’s accelerating transformation (retail opportunities included)—from build-to-rent in Madrid to hotel revamps in Seville—the Luxembourg SCSp offers a fast, flexible, and tax-efficient launchpad. Its rapid formation process, customizable governance, and favorable tax treatment make it an ideal structure for asset managers, private equity sponsors, and institutional players ready to act decisively across the Iberian market. Please contact your Damalion expert now.

10 Must-Do Activities in Spain During Your 2-Day Business Trip

Spain blends business efficiency with cultural richness like few other countries. Whether you’re in Madrid, Barcelona, or Valencia, these 10 experiences will elevate your short stay—without compromising your meeting schedule. Each activity includes a link to the official website for easy planning.

1. Have a Morning Espresso Meeting at Café Comercial (Madrid)

One of Madrid’s oldest and most iconic cafés, Café Comercial offers an elegant setting for early client conversations or a quick solo planning session before a full day of meetings.

2. Dine at Botín – The World’s Oldest Restaurant (Madrid)

Entertain clients at the Guinness World Record-holder for oldest restaurant, famous for its roast suckling pig and Spanish wine list.

3. Enjoy a Rooftop Cocktail at Sky Bar at Grand Hotel Central (Barcelona)

Take in panoramic city views after hours. Ideal for informal meetings or solo unwinding after a packed agenda.

4. Stroll the El Retiro Park Before or After Meetings (Madrid)

If your meetings are near the city center, a walk through this lush, historic park can provide a much-needed mental reset.

5. Reserve Dinner at Disfrutar – 2 Michelin Stars (Barcelona)

Ranked among the world’s top restaurants, Disfrutar offers modern Spanish cuisine in a refined setting—ideal for closing high-level deals.

6. Tour the Royal Palace in Under an Hour (Madrid)

Book a fast-track ticket and explore Spain’s largest royal residence between meetings. Guided or self-paced options available.

7. Attend an Exhibit at IVAM – Institut Valencià d’Art Modern (Valencia)

A top cultural venue for modern art lovers, IVAM hosts rotating exhibitions and installations—perfect for a brief cultural break.

8. Grab a Quick Power Lunch at Flax & Kale (Barcelona)

Located near Plaça Catalunya, this health-forward spot serves fresh juices, proteins, and plant-based meals—ideal for a light yet energizing break.

9. Shop Local at Santa Catalina Market (Barcelona)

A vibrant market where you can buy gourmet souvenirs, enjoy local delicacies, or grab a quick bite before heading to the airport.

10. End the Trip with Wine Tasting at Vinoteca Barbechera (Madrid)

Close your business trip on a relaxed note with a Spanish wine tasting. Excellent atmosphere for solo enjoyment or client send-off.