In Luxembourg, UCITS funds are designed for public distribution, so both retail and professional investors may invest if the fund’s prospectus allows it and local marketing rules are respected. Individuals, companies, pension funds, insurers, banks and family offices...

KNOWLEDGE CENTER

Private debt for operating platforms in real estate: aligning interests and enhancing returns

Private debt at the platform level lets operating platforms in Luxembourg, across Europe, and in the USA finance roll-outs, conversions, and scale-ups with tailored covenants tied to KPIs such as occupancy, ADR/RevPAR, rent per sqm, DSCR, EBITDA margin, and capex...

World Series Game 7: Dodgers Repeat as Champions

World Series Game 7: Dodgers Repeat as Champions After 5–4 Win The Los Angeles Dodgers made history by defeating the Toronto Blue Jays 5–4 in 11 innings to win the 2025 World Series. Will Smith’s dramatic home run in extra innings secured Los Angeles its second...

Custodian bank for your Luxembourg investment fund: how to pick the right partner depositary

Selecting a Luxembourg depositary is a regulatory obligation for UCITS and most AIFs, and a strategic choice that shapes investor protection, cash discipline, and closing certainty. Damalion helps you select the right partner depositary bank for your fund success. Our...

JPMorgan Steps Into Tokenized Finance with Its First Private-Equity Blockchain Fund

JPMorgan Chase launched its first blockchain-based private-equity fund, a milestone in how Wall Street administers alternative assets. Shorter settlement cycles, clearer ownership records, and automated fund flows are moving from pilots to production. JPMorgan...

How Sport athletes use Luxembourg Holdings and Funds to build long-term wealth

Professional athletes experience one of the fastest wealth cycles in the world. A 22-year-old footballer can sign a multimillion-euro contract, a Formula 1 driver may collect global sponsorship fees from five jurisdictions, a tennis champion can win prize money across...

Goldman Sachs Launches ETF to Mirror Private Equity Returns: GTPE Debuts on Market

Goldman Sachs Asset Management, in collaboration with MSCI, launched the Goldman Sachs MSCI World Private Equity Return Tracker ETF (GTPE), targeting private equity–like returns by tracking an MSCI index built from publicly listed securities. The ETF combines a...

Venture capital investment fund: how to use the Luxembourg investment funds

Why Luxembourg for a Venture Capital Fund? Luxembourg is a leading investment fund centre used by venture capital managers, entrepreneurs, family offices, pension funds, and institutional LPs to structure scalable, cross-border vehicles. It offers a predictable legal...

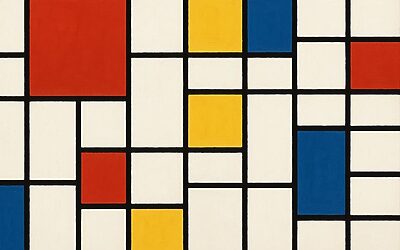

Art Securitization: Finance Fine Arts for Investors & Owners

Art Securitization in Luxembourg: Legal Opportunities and Cross-Border Perspectives Luxembourg’s advanced securitization framework has become a magnet for global investors seeking structured, legally compliant vehicles to diversify their portfolios. Beyond traditional...

Evergreen funds in Luxembourg: friendly guide for investors and founders

Evergreen funds are perpetual or open-ended vehicles that let you invest in private assets with scheduled liquidity windows. Luxembourg is a natural home thanks to flexible fund wrappers, seasoned providers, and EU passporting. If you want long-term private-market...