Selecting a Luxembourg depositary is a regulatory obligation for UCITS and most AIFs, and a strategic choice that shapes investor protection, cash discipline, and closing certainty. Damalion helps you select the right partner depositary bank for your fund success. Our following guide explains eligibility, duties, onboarding, pricing, and local operating context in Luxembourg City.

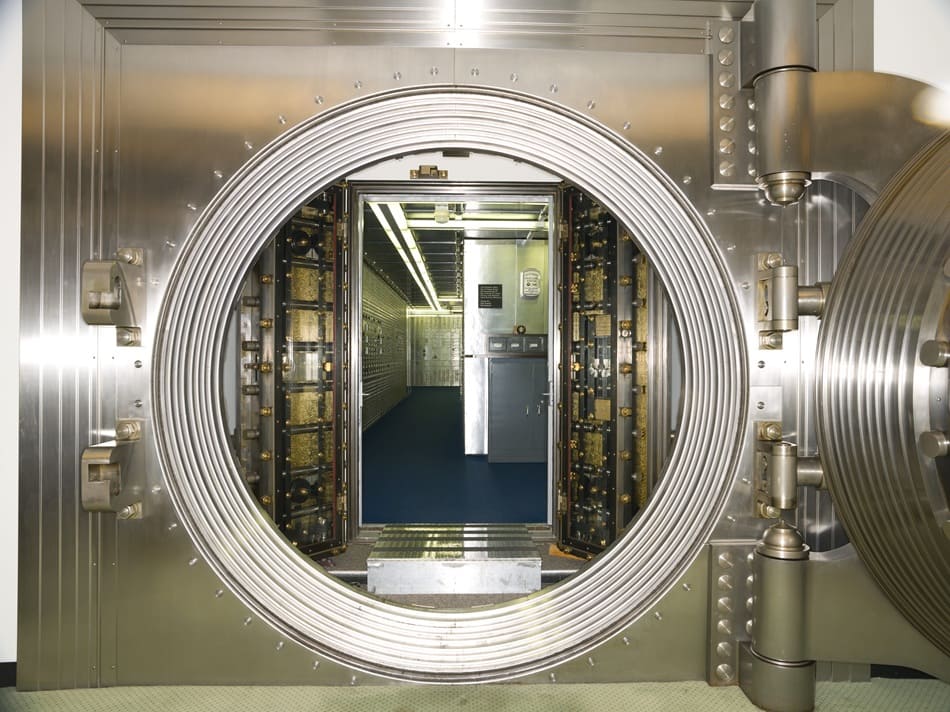

Why is Luxembourg the right jurisdiction for depositary services?

Luxembourg offers EU passporting, predictable supervision, and an integrated ecosystem. Financial services are concentrated in Kirchberg (Avenue John F. Kennedy), Ville Haute (Boulevard Royal, Grand-Rue), and Gasperich/Cloche d’Or. The country counts roughly abt. 682,000 residents and a multilingual workforce serving international sponsors. Consequently, depositaries, AIFMs/ManCos, administrators, law firms, notaries, and payment agents are within minutes, reducing friction during KYC, document execution, and incident resolution.

Which Luxembourg vehicles must appoint a depositary and who is eligible?

UCITS and most AIFs, including Part II funds, SIF, SICAR, and RAIF (via the AIFM), appoint a depositary established in Luxembourg. Eligible providers include Luxembourg credit institutions and investment firms. For certain private-asset strategies, a professional depositary of assets other than financial instruments can be appointed, subject to applicable rules. This structure centralises safekeeping, oversight, and cash-flow monitoring under one accountable party in Luxembourg.

What are the depositary’s core legal duties?

The mandate includes three pillars: (1) safekeeping of financial instruments in custody or record-keeping for other assets, (2) oversight of the fund’s operations, including subscriptions/redemptions and valuation processes, and (3) cash-flow monitoring, including reconciliations and signatory controls. Practically, the depositary verifies ownership evidence for non-custodiable holdings and supervises adherence to the fund’s constitutional documents and applicable law.

How should liquid and private-asset strategies shape your shortlist?

For liquid strategies, emphasise global sub-custody reach, corporate actions, tax reclaims, intraday cash, and FX. For private assets (PE/VC, private credit, infrastructure, real estate), focus on asset verification, escrow design, capital-call discipline, SPV look-through, and evidence trails supporting acquisitions, drawdowns, and disposals. Request anonymised case studies, sample oversight memos, and proof of delegation due-diligence on sub-custodians and agents.

What should the onboarding workplan include?

- Term sheet and scope. Asset classes, jurisdictions, leverage, FX, reporting packs, and account architecture.

- KYC/AML. Identification for GP, AIFM/ManCo, fund, UBOs, directors, and authorised signatories.

- Operating memorandum. Subscriptions/redemptions or capital calls, escrows, waterfalls, distributions, and breach handling.

- Service Level Agreement (SLA). Cut-offs, NAV calendar, reconciliation cycles, incident logging, and target turnaround times.

- Delegation oversight. Sub-custody networks, paying agents, cash correspondents, and escrow frameworks.

In practice, well-prepared files complete in approximately 4–10 weeks, subject to investor typology, private-asset complexity, and external dependencies (notaries, registries, banks).

How do depositary fees work and what is market-consistent?

Pricing typically combines a base fee per vehicle/sub-fund, a basis-point charge on assets under custody/oversight, and activity fees (transactions, corporate actions, capital calls, multiple cash accounts). Private-asset strategies attract additional verification effort. To ensure fairness, request tiered fee schedules, model 12-month flows, and test how charges scale with SPV counts and AUM ramps.

Can one group provide AIFM/ManCo, administration, and depositary?

Yes, large groups can deliver bundled services. From a legal-risk perspective, require demonstrable functional separation, conflict management, and independent escalation paths. Many sponsors combine a specialist AIFM, a preferred administrator, and a depositary with a strong private-asset oversight record; this model remains common and defensible.

What should real estate and infrastructure funds verify?

- Legal title chains, security interests, and SPV ownership by jurisdiction.

- Escrow mechanics, notarial steps, and drawdown evidence for capex schedules.

- Rental cash-flow monitoring, debt covenants, and waterfall controls.

- Account structures for operating, capex, and distribution flows with dual-control.

How does Luxembourg’s city layout support efficient closings?

Meetings near Avenue J.F. Kennedy or Boulevard Royal allow back-to-back sessions with the depositary, AIFM, and counsel. Cloche d’Or provides modern HQ space and quick road links for regional visitors. Tram and airport access compress travel time for signings and investor meetings, which helps keep closings on calendar.

What common pitfalls should be avoided?

- Selecting on headline bps alone without modelling verification and activity-based fees.

- Underestimating non-custodiable asset checks and associated evidence requirements.

- Leaving cash architecture, signatory matrices, and cut-offs vague in the Service Level Agreement (SLA).

- Skipping an operating pilot covering a capital call, reconciliation, and incident escalation.

Key features & benefits (and how to apply them)

Adopt the steps below to secure an eligible, operationally reliable Luxembourg depositary with a clear audit trail.

- Define your assets and flows. Catalogue instruments, jurisdictions, leverage, FX, and 12-month cash events.

- Pre-qualify 3–5 depositaries. Confirm Luxembourg eligibility, private-asset coverage, and provide sector-relevant examples.

- Run a data-led RFP. Share pipeline details; request tiered pricing, look-through methods, and target turnaround times.

- Test the model. Pilot one capital call and a NAV cycle; evaluate reconciliations and escalation timing.

- Lock the SLA and exits. Fix KPIs, breach thresholds, sub-custody oversight, and off-boarding provisions.

Further reading on Damalion

- Launching a Luxembourg RAIF for global investors

- What is a RAIF and who can invest

- SCSp vs SCS explained for sponsors

- Create your Luxembourg SOPARFI holding

- How to set up your Luxembourg holding company

- How to incorporate a Luxembourg SPF

Consult our guides

- Guide to register your company in Luxembourg

Incorporation routes, legal forms, timelines, and mandatory filings.

- Step-by-step: start a business in Luxembourg

From name check to bank account, VAT, and operational go-live.

- Reserved Alternative Investment Fund (RAIF) guide

Structure, eligible investors, diversification, and AIFM linkage.

- Luxembourg securitization guide

SVs, compartments, eligible assets, and investor documentation.

- SOPARFI holding company guide

Governance, participation exemptions, and group financing points.

Official sources and industry context

| Criterion | Liquid strategies | Private-asset strategies |

|---|---|---|

| Safekeeping | Global sub-custody, corporate actions | Ownership verification, SPV chain checks |

| Cash monitoring | Intraday, FX sweeps | Escrow, capital calls, waterfalls |

| Reporting | Daily positions, NAV breaks | Deal-level evidence, drawdown tracking |

| Pricing | AUC bps + activity | Oversight intensity + verification |

| Governance | Cut-offs, standing instructions | SLA KPIs, incident escalation |

FAQs: Luxembourg fund depositaries

Do all Luxembourg funds need a depositary?

UCITS and most AIFs do. RAIFs appoint a depositary through their AIFM.

Must the depositary be in Luxembourg?

Yes, the depositary must be established in Luxembourg or via an eligible Luxembourg branch.

What are the core duties of a depositary?

Safekeeping of assets, oversight of the fund, and cash-flow monitoring.

Can I use a professional depositary for private assets?

Yes, professional depositaries of assets other than financial instruments are possible for certain AIFs.

How long does onboarding take?

Typically 4 to 10 weeks depending on structure and investor profile.

What information will the depositary request?

Fund documents, KYC, operating memos, delegation details, and pipeline evidence.

How do depositary fees work?

A base fee plus asset-based and activity fees, with higher intensity for private assets.

Can the depositary be in the same group as the administrator?

Yes, if functions are properly separated with conflict controls.

How is cash monitored?

Via reconciliations, signatory checks, cut-offs, and exception reporting.

What does asset verification mean for private funds?

Ownership proof, legal title checks, and review of transaction evidence.

Does the depositary review valuations?

It oversees the process and controls but does not replace the valuation function.

Can we change depositary after launch?

Yes, via a planned migration with investor notices and contract novations.

Which areas of Luxembourg host many depositaries?

Kirchberg, Boulevard Royal in Ville Haute, and Gasperich—Cloche d’Or.

Are real estate funds common in Luxembourg?

Yes, and depositaries are experienced with SPVs, escrows, and rental flows.

Who can help me meet depositaries?

Damalion can introduce you to selected Luxembourg depositaries matched to your strategy.

10 leading banks in Luxembourg

- Banque et Caisse d’Épargne de l’État (BCEE)

Luxembourg’s state-owned bank offering retail, corporate, and institutional services.

- BGL BNP Paribas S.A.

A top-tier bank with investment, private, and corporate banking divisions.

- Société Générale Luxembourg

Full-service bank providing private wealth, securities, and fund administration.

- Deutsche Bank Luxembourg S.A.

Strong in cross-border structures, cash management, and fund servicing.

- Banque Internationale à Luxembourg (BIL)

Luxembourg’s oldest universal bank serving corporates and private clients.

- ING Luxembourg S.A.

International bank combining local service with digital and corporate banking expertise.

- Banque de Luxembourg S.A.

Private bank focusing on long-term wealth management and fund services.

- Banque Raiffeisen

Cooperative retail and SME bank with a wide national branch network.

- Advanzia Bank S.A.

Digital Luxembourg bank specialising in credit cards and online deposits.

- Intesa Sanpaolo Bank Luxembourg S.A.

Subsidiary of the Italian group offering corporate and private banking services.

10 best things to do in Luxembourg during a 24-hour business trip

Damalion supports entrepreneurs, investors, and family offices with compliant incorporation, banking coordination, and legal/tax alignment.

This information is not intended to be a substitute for specific individualized tax or legal advice. We suggest that you discuss your specific situation with a qualified tax or legal advisor | External links are ownership of their respective owners and do not imply any economic link or interest with Damalion corporation.