Is ELTIF 2.0 a European framework or only for Luxembourg?

The ELTIF regime is an EU regulation (amended by Regulation 2023/606). It applies uniformly across EU and EEA member states — Luxembourg, Spain, France, Germany, Italy, and more. You can set up your fund in Luxembourg for speed and expertise, then invest in qualifying projects across Europe.

ELTIF 2.0 can invest anywhere in the European Union

Even if your European Long-Term Investment Fund 2.0 is domiciled in Luxembourg, it can invest across all EU countries — including Spain. For clarity, here are straightforward examples that fit the long-term mandate:

- A Luxembourg-based fund financing solar farms in Andalusia, Spain.

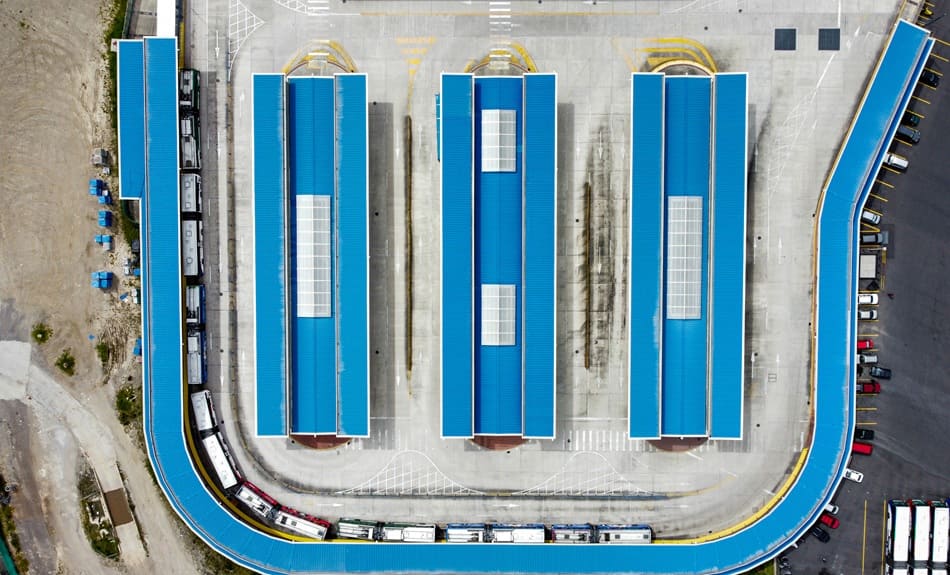

- Investing in logistics parks in Madrid or industrial hubs near Barcelona.

- Providing long-term loans to Spanish infrastructure projects.

- Acquiring equity in Spanish small and medium-sized enterprises (SMEs) that meet the criteria.

What changed under ELTIF 2.0?

With the scope clear, let’s look at the practical changes that make this regime more attractive.

ELTIF 2.0 made it easier to build diversified, long-term portfolios, including broader funds-of-funds, private credit, infrastructure, and real assets. Portfolio composition and borrowing rules are more flexible, helping managers match long-dated projects with long-dated capital.

Who can invest in a Luxembourg ELTIF 2.0?

Investor eligibility is broader now, which matters for wealth managers and private banks.

Professional investors can subscribe widely. Retail investors can access ELTIFs subject to suitability checks and disclosures. This makes the format relevant for private banks, wealth managers, pension funds, and family offices planning multi-year allocations.

What assets qualify under ELTIF 2.0 in Luxembourg?

The rules also expand the menu of long-term assets you can hold.

Eligible assets span unlisted equity or debt of qualifying portfolio companies, real assets and infrastructure, and units of other funds under conditions. There’s also more room to use private credit within a long-term strategy.

What is not permitted or still restricted?

That said, the structure remains built for patient capital, not short-term trading.

ELTIFs are not designed for high-frequency trading or speculative turnover. Liquidity features must align with the fund’s long-dated investments and redemption mechanics.

Where are the opportunities in Luxembourg’s real economy?

Local dynamics still matter for pipeline and underwriting; here’s what we see on the ground.

Luxembourg’s population is roughly 682,000 in 2025, with robust migration and a services-driven economy. That supports demand in housing, logistics, and modern offices — especially in well-connected districts.

Which Luxembourg districts and streets should investors know?

If you plan meetings or assets locally, these districts and streets are your anchor points.

- Kirchberg along Avenue John F. Kennedy — EU institutions and many financial firms.

- Cloche d’Or in Gasperich — fast-growing business district with mixed use.

- Grand Rue — prestigious retail and professional services in the old town.

What are the key cities for deployment beyond the capital?

Beyond the capital, several cities support growth and redevelopment strategies.

Consider Esch-sur-Alzette (dynamic redevelopment), Differdange (industry and housing demand), and Dudelange (well-connected, mixed-use growth).

How is the office market evolving for long-term allocations?

Office remains selective: supply, ESG refits, and yields are the moving parts.

Vacancy edged up with new deliveries, while pre-leasing stabilizes prime assets. That favors selective development and refurbishment to modern ESG standards. Pricing caution creates entry points for value-add strategies.

Quick comparison: ELTIF 1.0 vs ELTIF 2.0

| Topic | ELTIF 1.0 | ELTIF 2.0 |

|---|---|---|

| Real assets threshold | Higher barriers for real assets | Lowered constraints, broader access |

| Funds-of-funds | Limited | Allowed under conditions |

| Borrowing | Tighter | More flexible |

| Retail access | Narrow | Broader with safeguards |

How do I launch an ELTIF 2.0 in Luxembourg?

Execution is straightforward with the right partners; here’s a clean sequence.

Pick an authorized EU AIFM, align your strategy with ELTIF eligibility, design the liquidity and valuation model, and prepare the CSSF application. With the right partners, timelines are predictable and distribution can scale across the EU.

ELTIF 2.0: step-by-step “Key Features & Benefits” with Damalion support

To make this tangible, follow the steps below and align them with your distribution plan.

- Define your ELTIF strategy around private equity, private credit, infrastructure, or real assets.

- Select a Luxembourg AIFM and depositary experienced with ELTIFs.

- Design portfolio limits, leverage, and liquidity tools consistent with long-term assets.

- Draft the prospectus, KID (if retail), and disclosures aligned with CSSF expectations.

- Plan distribution across EU channels, including private banks and platforms.

- Set up reporting, valuation, and governance to support multi-year holdings.

ELTIF 2.0 in Luxembourg — sectors we’re watching

Sector selection drives outcomes; these themes currently show durable demand.

We’re seeing momentum in energy transition infrastructure, modern logistics, data-driven services, and selective residential development.

What is the tax regime of a European Long-Term Investment Fund 2.0 in Luxembourg?

Tax clarity often decides the jurisdiction; here is the practical overview.

Luxembourg offers one of the most efficient and transparent tax frameworks in Europe for setting up an ELTIF 2.0. While the fund’s regulation is European, the tax treatment depends on the legal vehicle chosen for the Luxembourg structure — such as a SOPARFI, a Reserved Alternative Investment Fund (RAIF), or a SICAV-RAIF.

1. Fund-level taxation

- Corporate income tax: Most Luxembourg regulated funds (including many RAIF, SIF, SICAV structures) are generally exempt from corporate income tax and municipal business tax. Depending on setup, some vehicles are treated as tax-transparent or semi-transparent.

- Subscription tax: Instead of income tax, Luxembourg funds typically pay a low subscription tax of 0.01% to 0.05% per annum of net asset value, depending on fund type and asset class. Certain categories may be exempt.

- Value-added tax: Fund management services are typically exempt from VAT in Luxembourg, which helps reduce running costs.

2. Investor-level taxation

- Non-resident investors: Dividends, capital gains, or income distributions received from Luxembourg funds are generally not subject to Luxembourg withholding tax for non-residents.

- Resident investors: Luxembourg residents are taxed under their personal or corporate rules and may benefit from double tax treaties where applicable.

- Capital gains: Investors typically enjoy tax neutrality on capital appreciation realized through Luxembourg-domiciled funds.

3. Cross-border tax efficiency

Thanks to its network of many double tax treaties, Luxembourg supports efficient repatriation of income for cross-border projects — for example, investments in Spain, France, Germany, or Italy.

4. Comparison snapshot: Luxembourg vs Spain for setup

| Tax aspect | Luxembourg | Spain |

|---|---|---|

| Corporate income tax | Usually exempt for regulated funds | Generally 25% corporate income tax |

| Subscription tax | 0.01% – 0.05% per year | Not applicable |

| Withholding on dividends to non-residents | Typically 0% | Generally 19% (treaty reductions possible) |

| EU distribution passport | Available under CSSF authorization | Available under CNMV authorization |

Helpful internal resources

- Luxembourg SOPARFI FAQs (FR) for holding-company layers in ELTIF structures

- How to incorporate your SPF for wealth-planning blocks around ELTIF investors

- Company structures in Luxembourg to compare vehicles used alongside ELTIFs

- Launch a Luxembourg RAIF fund for international investors

- Reserved Alternative Investment Fund (RAIF): overview and advantages

- How to incorporate a Luxembourg RAIF step by step

- How to open a Luxembourg SICAV-RAIF

- RAIF vs SIF: comparison for fund promoters

- RAIF quick facts (minimum capital, diversification, AIFM)

Frequently Asked Questions about ELTIF 2.0 in Luxembourg

It’s the updated EU long-term investment fund regime that broadens eligible assets and simplifies rules for long-term portfolios.2) Who regulates ELTIFs in Luxembourg?

The CSSF authorizes ELTIFs and oversees managers and disclosure requirements.3) Can retail investors access ELTIFs?

Yes, retail access is possible subject to suitability and disclosures.4) What assets can a Luxembourg ELTIF hold?

Private equity, private credit, infrastructure, real assets, and—under conditions—other funds.

5) Does ELTIF 2.0 allow funds-of-funds?

Yes, subject to limits and due-diligence.

6) Are borrowing limits more flexible now?

Yes, leverage rules are more accommodating to long-term projects.

7) How liquid is an ELTIF?

Liquidity must match long-dated assets; redemption tools are carefully structured.

8) Why choose Luxembourg for ELTIF?

Experienced AIFMs, EU passporting, and a predictable regulator.

9) Can a Luxembourg ELTIF invest in Spain?

Yes, a Luxembourg-domiciled ELTIF can invest across the EU, including Spain.

10) Is an ELTIF limited to investing in Luxembourg only?

No, the framework is European; investments can be made across EU and EEA member states.

11) What are the key tax points for investors?

Luxembourg funds typically have no withholding tax for non-residents and apply a low subscription tax at fund level.

12) How big is Luxembourg’s population?

About 682,000 residents as of 2025, with strong migration.

13) What market sectors look promising?

Energy transition, logistics, data-enabled services, and targeted residential.

14) What documents are needed to launch?

Prospectus, depositary and AIFM agreements, and retail disclosures if applicable.

15) How long does authorization take?

Timelines vary; with complete files and experienced teams, processes are predictable.

This information is not intended to be a substitute for specific individualized tax or legal advice. We suggest that you discuss your specific situation with a qualified tax or legal advisor | External links are ownership of their respective owners and do not imply any economic link or interest with Damalion corporation.

10 best things to do in Luxembourg City during a 24-hour business trip

- City Promenade to get your bearings fast. Jump to map

- Bock Casemates for a dramatic historic walk.

- Kirchberg lunch & quick retail near Avenue John F. Kennedy.

- Tram ride from Luxexpo to the old town for a skyline view.

- National Museum of History and Art for an hour of culture.

- Grand Ducal Palace exterior stroll between meetings.

- Philharmonie architecture stop in Kirchberg.

- MUDAM quick contemporary art fix.

- Dinner in Grund along the riverside.

- Sunrise walk in Pétrusse valley before departure. Back to list